Let’s talk about something that can make a big difference when you’re financing a car: comparison rates.

You’ve probably heard of interest rates, but comparison rates are just as important, if not more so. They give you a clearer picture of the total cost of your loan, helping you make a smarter decision.

Think of it like this: the interest rate is the base price, but the comparison rate includes all the extras, like fees and charges, so you know exactly what you’re paying.

A comparison rate is a single figure that considers the interest rate plus other fees and charges associated with a car loan. It’s designed to give you an “apples-to-apples” view of different loan products, making it easier to compare them side-by-side.

It’s calculated based on a standard loan amount and term, so you can compare loans even if they have different interest rates or fee structures. ASIC’s MoneySmart website has a great explanation of comparison rates that you might find useful.

The interest rate is the percentage of the loan amount that you’ll be charged in interest. It’s a key factor, of course, but it doesn’t tell the whole story. Fees and charges can add up, significantly increasing the overall cost of your loan. That’s where the comparison rate comes in. It combines the interest rate with these extra costs, giving you a more complete picture of what the loan will actually cost you. MoneySmart also offers a helpful car loan calculator so you can see how different rates and fees affect your repayments.

Comparison rates are your secret weapon when navigating the world of car loans. They empower you to make truly informed decisions by revealing the total cost of a loan, not just the flashy interest rate.

Think of it like comparing the overall price of two seemingly similar cars – one might have a lower sticker price, but hidden costs like delivery fees or expensive extras can make it more expensive in the long run.

That’s what comparison rates help you avoid.

By focusing on the comparison rate, you can dodge those sneaky hidden fees and charges that lenders sometimes bury in the fine print.

Things like application fees, establishment fees, or even ongoing monthly charges can significantly inflate the cost of your loan.

The comparison rate bundles all these costs together into a single, easy-to-understand figure, allowing you to confidently compare different loan offers side-by-side. No more sifting through pages of complex documents trying to decipher which loan is actually the best value.

With the comparison rate, you can choose the loan that truly suits your budget and drive away knowing you’ve made a smart financial decision. It’s all about putting you in control and saving you money in the long run.

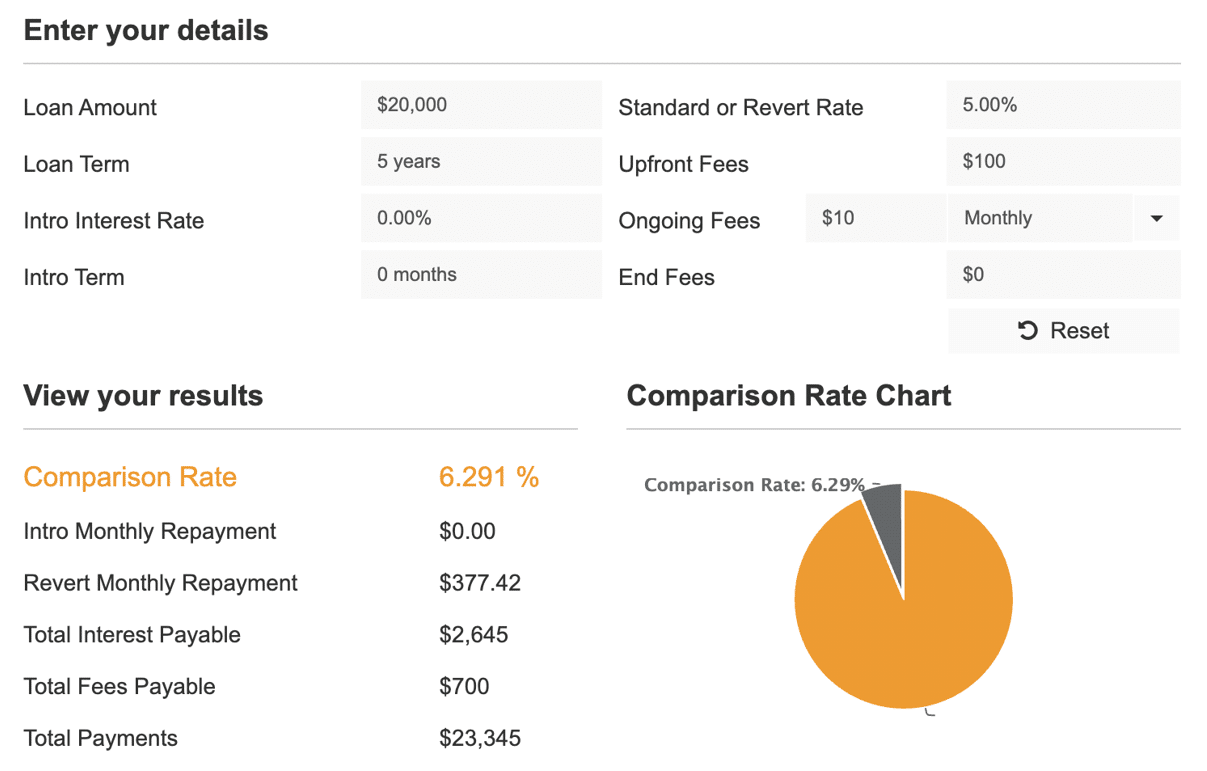

Okay, let’s break down how Car Loan Comparison Rates can save you money with a real-world example.

Imagine you’re looking to borrow $20,000 to buy a used car. You’ve found two loan offers that seem pretty similar at first glance.

Loan A is advertising a 5% interest rate, while Loan B has a slightly higher rate of 5.5%. You might think Loan A is the obvious choice, right? Not so fast!

Loan A also comes with a hefty $500 in upfront fees – things like application fees, establishment fees, and other charges. Loan B, on the other hand, has lower fees, totalling only $200.

Now, here’s where the Car Loan Comparison Rate comes in. It takes both the interest rate and those fees into account, giving you a single figure that represents the true cost of the loan.

In this scenario, even though Loan A has a lower interest rate, the higher fees could actually make it more expensive overall. The Car Loan Comparison Rate would likely be higher for Loan A than Loan B, revealing that Loan B is the better deal despite the slightly higher interest rate.

It’s like comparing the total price of a flight, including baggage fees and taxes – the cheapest base fare isn’t always the cheapest overall.

By focusing on the Car Loan Comparison Rate, you can easily compare these two loans and see which one will actually cost you less in the long run.

Don’t just get distracted by the initial interest rate – it’s the comparison rate that tells the whole story and helps you make a smart financial decision.

Remember, it’s not just about what you pay upfront, but the total cost of borrowing that really matters.

This explanation helps illustrate the concept of how fees affect the overall cost of borrowing and how the comparison rate provides a more complete picture than the interest rate alone.

Working all this out can be tricky, and that’s where we come in. Your dedicated Lending Specialist at Fox Finance Group can act as your guide and help decipher the numbers to find you the best deal on the market today.

We’ll take the hassle out of comparing loans, so you can drive away with confidence, knowing you’ve got a great rate and the best deal on the market. Give us a call on 1300 665 906 or visit our website apply online for obligation free help to get started.

|

Rowdie Lang |

Rowdie has been a part of our Team since 2020. He has witnessed firsthand the ongoing evolution of the finance industry as technology continues to change the way customers' access financial services. He has a passion for helping people and relishes the opportunity to work alongside our teams every day as they help our customers financial dreams come true. |

|

Reviewed by: Nathan Drew ✅ Fact checked 📅 Last updated: Dec 11, 2025 |

|

A car loan comparison rate combines the interest rate plus most associated fees and charges into a single percentage. This gives a clearer indication of the loan’s true cost, not just the base interest.

Comparison rates help you make an accurate comparison by including fees that can increase total repayments. They prevent being misled by a low interest rate alone.

Yes. The comparison rate includes fees, a loan with a slightly higher interest rate but minimal fees may end up cheaper over time than one with a lower rate but high extra costs.